Half a world away in the Malaysian state of Pahang, a member of the Temuan community – an orang asli (indigenous) ethnic group harvests a cocoa pod, to be sold to a local chocolatier. These are foraged from the wild and grow as solo trees rather than in organised plantations. Their way of life has been unchanged for generations and many depend on rubber tapping and forest foraging for an income.

From Paris to Pahang: the two locations are distinct but connected threads that make up the auburn fabric of the chocolate world. For centuries, the relationship between cocoa production and chocolate consumption has been a portrait depicting the haves and the have nots.

Countries home to cocoa bean farms are often developing or middle income countries which supply raw materials to Western production centres thousands of kilometres away. Most chocolates produced by these origin growing countries are often seen as inferior, made by constituting low quality cocoa powder with vegetable fat – not cocoa butter as is the case of quality chocolates.

“I’m from Australia and my family had a vineyard in South Australia,” Garritt continues. “And where you have the vineyard, you have the winery. No one would imagine taking Australian grapes to France and calling that a French wine. And yet, it’s perfectly normal for cocoa to travel thousands of kilometres and somehow it becomes French or Swiss. Why is that?”

The Big Change

But a tectonic shift is happening. Garritt is part of a growing crop of Southeast Asia-based fine chocolate makers who operate a short distance away from cocoa tree farms. The CEO lives in Bali and uses Balinese cocoa beans for his range of chocolate bars

These makers are only a few years old, and the scene is at its infancy. But already, domestic and international coverage is picking up, along with export offers promising to take these bars to the global stage. What unites them is a sense of irony – that cocoa producing countries are not also home to premium chocolate makers.

Cocoa’s History in Southeast Asia

In part, it’s because of the global development of the chocolate economy. For all its sweetness and associations with luxury and romance today, chocolate has a dark history. That French, Swiss and Belgian chocolates are seen as the pinnacle of quality is a direct result of history – one that has seen the dawn of colonisation and heard the rallying cries for national independence.

Not to be outdone, other European powers began experimenting in their Southeast Asian colonies. The trees flourished but they found better commercial success with other cash crops. Spices are of greater value in the Dutch East Indies (present day Indonesia), rubber easily outweighed cocoa beans in Malaya while the French similarly found greater commercial imperative with growing coffee in Vietnam.

Instead, it is the fledgling chocolate companies in the European metropoles that would emerge as leviathans in today’s chocolate world. Van Houten was one such – the Dutch firm invented the cocoa press in 1828 – a hydraulic machine that separates cocoa solids from cocoa powder that made mass chocolate manufacturing a reality.

Over the course of a hundred years, many of the original chocolate makers have merged into massive multinationals. Fry’s was gobbled up by rival British chocolate company Cadbury in 1919 which was in turn acquired by Kraft Foods in 2010. Belgian chocolate maker Callebaut and French Firm Cacao Barry merged in 1996 to form Barry Callebaut which today produces 1.7 million tonnes of cocoa per year.

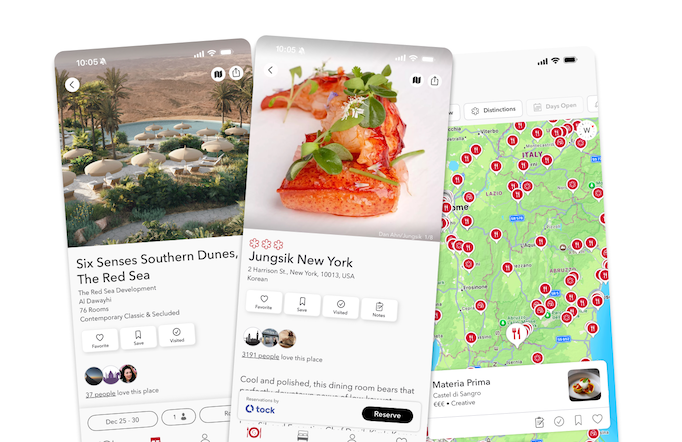

By the 2010s, change was in the air. Consumers started growing conscious of the source of their food and support for small producers took off. Craft beers boomed, as did the third wave coffee joints that swept much of the world’s cities. With it rose the bean-to-bar chocolatier that was the antithesis of everything a multinational offers: terroir sensitivity, fair trade and to some, exclusivity.

These new wave of chocolate makers do everything from purchasing their own cocoa beans, grinding them down on site, moulding, packaging and marketing them.

There was just one problem: few are based in the origin growing countries. This distance and lack of direct access to farmers has led to criticism of bean-to-bar makers for using inferior beans even if the products are single origin.

One such critic is Frederic Loraschi, a pastry chef and consultant for juggernauts like Hershey who believes that bigger buyers get better beans. “These guys get the best beans because they buy big volumes and can afford it,” he tells trade website Confectionerynews.com. “The others buy leftovers that nobody wants.”

Small chocolatiers are not able to afford traveling regularly to form strong relationships or control the fermentation process, he says.

And that’s exactly where Southeast Asia’s chocolate makers have an edge. Living a short day trip away from the farms means they are, “[not only] able to be on site to inspect the beans,” says Ning of Chocolate Concierge, “but are able to take it one step further, which is to start from the tree itself.”

Agreeing, Garritt (pictured left) says: “How do you know if you’ve got a high quality raw material? The first thing you have to do is go into the farm and ask yourself, is this a healthy and happy looking farm? If it isn’t why is that?”

Part of the appeal of these bean-to-bar chocolate makers is their social mission which has an impact on communities as much as on the quality of the cocoa beans that they get. They are closer economically and emotionally to these farms: their multiple sojourns into the cocoa growing depths of their countries often come with the intention of helping farmers to maximise yields, better cocoa quality and hence increase their earnings.

The week before we spoke to Arvin Peralta of Hiraya, he was visiting cocoa farmers east of Manila in an old port city where the Spanish first introduced cocoa to the region. Unlike in the south where there are established plantations and where he primarily already sources his beans, the cocoa trees here are much older and the farmers are not clued in on post processing techniques.

“The production is small and they don’t know how to ferment the beans which is required in making fine chocolates,” he says referring to the crucial step in which microorganisms work to develop chocolate’s flavour and colour.

The root of the issue is because the farmers themselves have never seen the end product.

One way his company gets around this is to receive beans from co-operatives and turn it into chocolate for them to sample. “So we provide feedback and input on their process even though we’re not the ones ultimately buying the beans,” he says.

Their efforts to help farmers don’t end there. Instead, they also typically pay the farmers higher prices. Pipiltin Cocoa for instance pays its suppliers 40-50% more than market price – the same figure that Pod Chocolate reports.

“At Marou we pay a significant premium over this local market price […] we pay more than the other buyers to have access to higher quality cacao before the other buyers.”

The Rise of The Affluent Class?

Naturally, this means fine chocolates costs more, rendering it almost an accidental luxury product. In The Philippines, a low quality chocolate bar could is priced as little as 20 to 40 Pesos while a bar of Hiraya chocolates rings up 180 pesos at the cash tills.

The clincher? The bulk of their customer base are local. It’s a sure sign that the tastebuds of at least a certain affluent segment of the Southeast Asian population are becoming not just more discerning but are developing a sensitivity to terroir and ethical consumption.

“There’s an emerging market for this similar to the third wave coffee trend,” says Peralta whose bars are often sold out at retail locations. “It’s mostly millennials and hipsters or the older generation who are looking for healthier options.”

“We are still at the infancy, but the trend is only moving one way and people are becoming more aware and asking the right questions. For me, the person who picks up the bar and doesn’t know the Malaysian bean-to-bar chocolate story goes, “wow, I want to know how the bar is made,” then that to me, is success.”

But beyond Asia, the common goal between these indie makers, is for the world to pivot to these cocoa-growing regions as fine chocolate producing countries too, and for farmers to have a fair shot at a better life.

These are valiant efforts, even if it’s at its nascence. It may not quite narrow the gap between Paris and Pahang or the haves and have nots just yet, but it does at least take it that much closer.